Global Food Recall Index: Q1 2025 Sees Alarming Rise in Recalls for Meat, Cereals, and Fresh Produce.

Acknowledgment of Horizon EFRA Project (Extreme Food Risk Analytics)

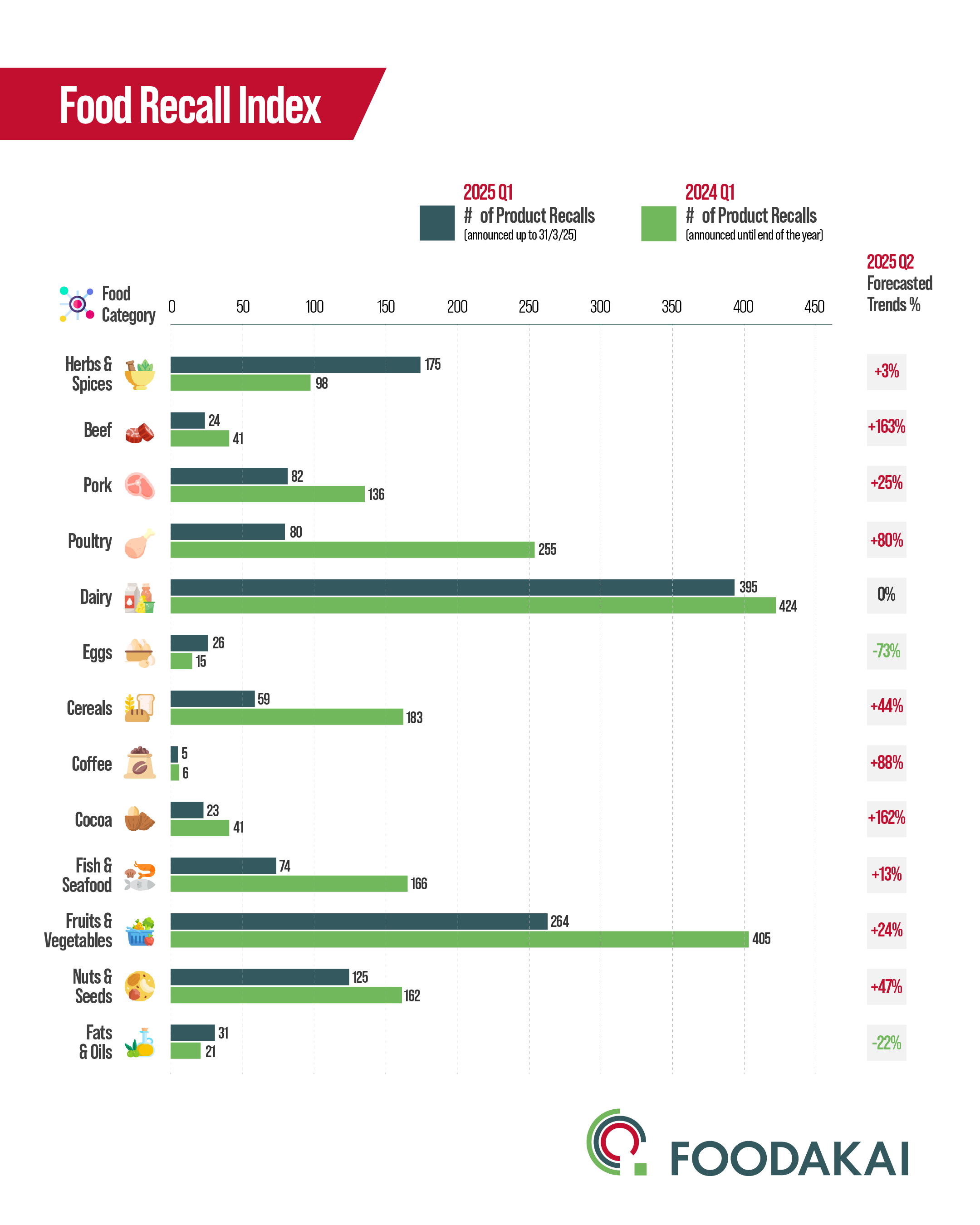

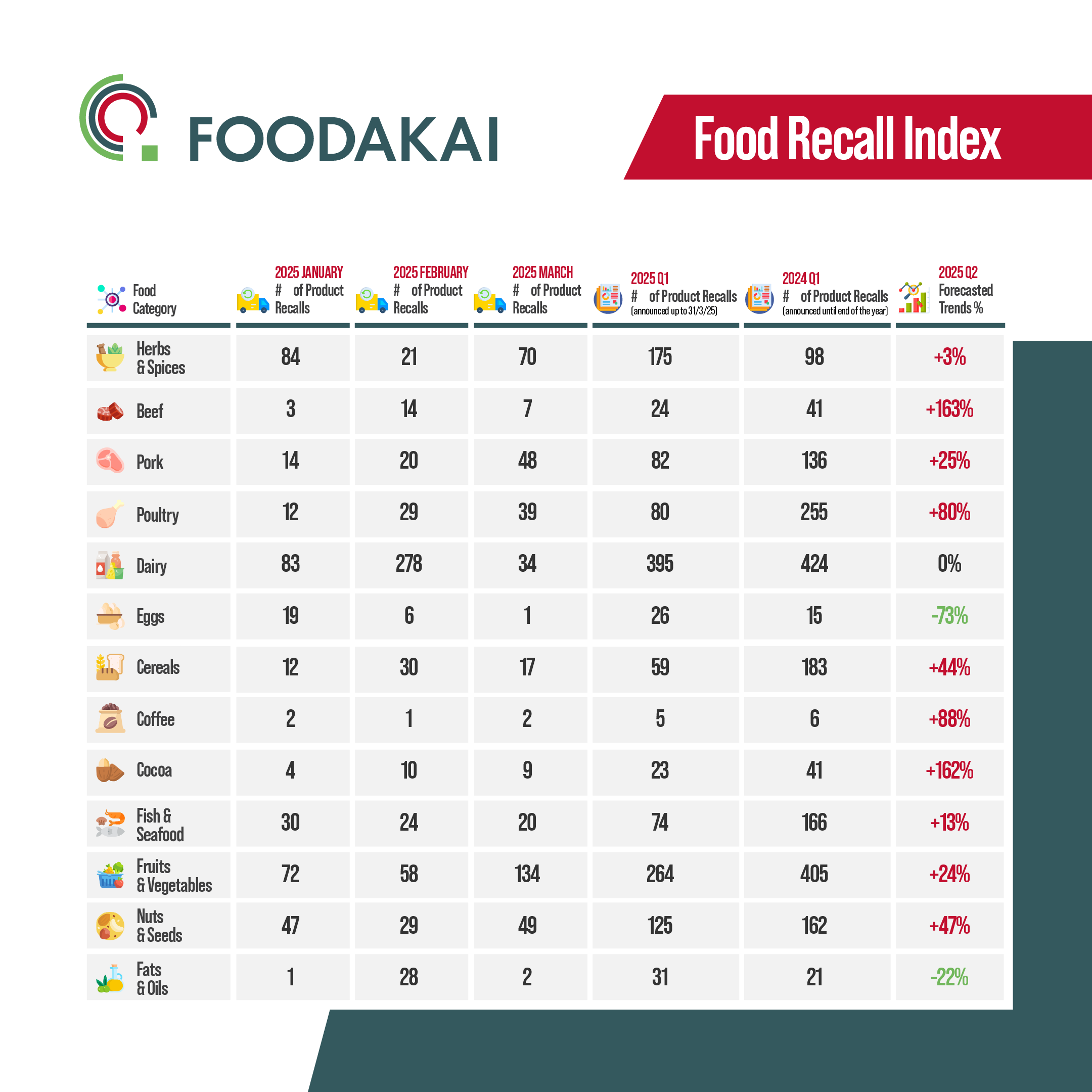

The first quarter of 2025 has exposed sharp increases in food recalls across critical supply chains, according to the newly released FOODAKAI’s Global Food Recall Index. With significant spikes in dairy, poultry, and fresh produce categories, the data suggests shifting risk dynamics that food manufacturers and safety leaders must closely monitor.

Published every three months, the Global Food Recall Index tracks product recalls issued by official food safety authorities across a selection of priority food categories. This quarterly update reflects the most pressing recall trends shaping food safety risk management.

Q1 2025: What the Food Industry Needs to Know

Dairy dominates recall activity again.

Dairy products led all categories in Q1 recall volume, driven by microbiological contamination and handling issues. The volume spike in February signals persistent cold chain and process control challenges. This category is expected to remain under pressure through Q2.

Meat and poultry show rare decline in recalls.

During the first quarter of 2025, there was a noticeable decrease in recalls for beef and pork products compared to the same period in 2024, indicating potential improvements in production practices or regulatory compliance. While poultry recalls were previously high, dairy emerged as a focus in 2025, showing a shift in reporting or product surveillance priorities. Nevertheless, based on the 3-month forecasted trend, recalls in these categories are expected to increase further in the coming months.

Cereals, cocoa, and fresh produce forecast showing emerging vulnerabilities in the second quarter.

In the first quarter of 2025, recalls for cereal and cocoa products showed a marked decline compared to the same period in the previous year, reflecting possible improvements in supply chain monitoring and contamination prevention. Recalls involving fruits and vegetable products also decreased, though they remained comparatively high, suggesting that while progress has been made, challenges persist in this category. In contrast with the first quarter, all three categories are forecast to be high-risk in the second quarter.

Eggs and oils recalls are climbing fast.

Contrary to the broader downward trend in food recalls across most categories, the first quarter of 2025 saw a rise in incidents involving egg products and fats & oils. In the case of eggs, this increase may be partially attributed to supply chain volatility stemming from the widespread impact of avian influenza, which led to significant losses in laying hen populations. These disruptions likely strained production systems, heightened vulnerability to quality deviations, and ultimately contributed to the elevated recall activity observed during this period. However, current forecasts for both categories suggest a potential decline in recalls in the coming months, reflecting expectations of improved stability and control measures.

About the Index

The FOODAKAI Global Food Recall Index is a quarterly snapshot of food product recall trends across ten critical food categories. Based on official data from national and international food safety authorities, the index helps manufacturers, regulators, and supply chain stakeholders anticipate emerging risks and benchmark recall activity over time.

📬 Want to monitor food safety risks before they escalate? Sign up for free alerts of globally reported food safety incidents.

Disclaimer: The data presented in this article is based on official food product recall information reported by national and international food safety authorities. While FOODAKAI continuously monitors and compiles these announcements with diligence, the accuracy and completeness of the original recall data remain the responsibility of the respective issuing authorities. FOODAKAI assumes no liability for any inaccuracies or omissions in the reported numbers. The forecasted trends included in this publication are indicative, based on historical patterns and current reporting, and are provided for general informational purposes only. They do not constitute advice or predictions and should not be relied upon for operational, legal, or regulatory decisions. Readers and stakeholders are advised to use this information responsibly and at their own discretion.

Acknowledgement of Horizon EFRA project (Extreme Food Analytics): This Food Risk Report was prepared under the EFRA project, as a Sectoral Data Report.

EFRA is a project that has received funding from the European Union’s Horizon Europe Research and Innovation Programme under Grant Agreement No 101093026

Project website: https://efraproject.eu