Sharp Rise in Fraud for Nuts, Dairy, and Cereals: Q1 2025 Findings from the FOODAKAI Global Food Fraud Index

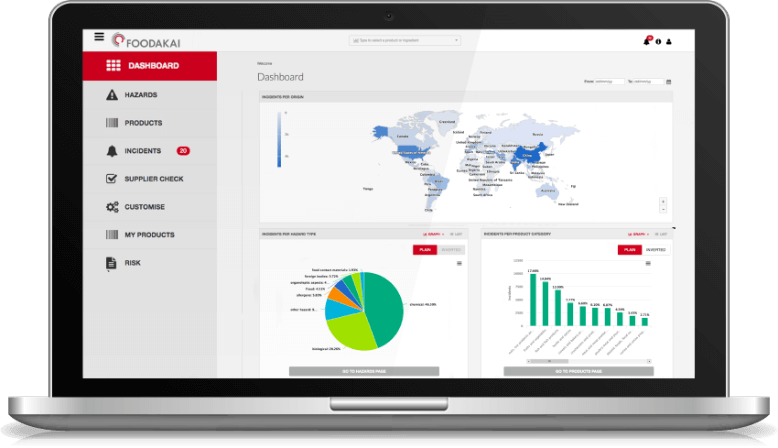

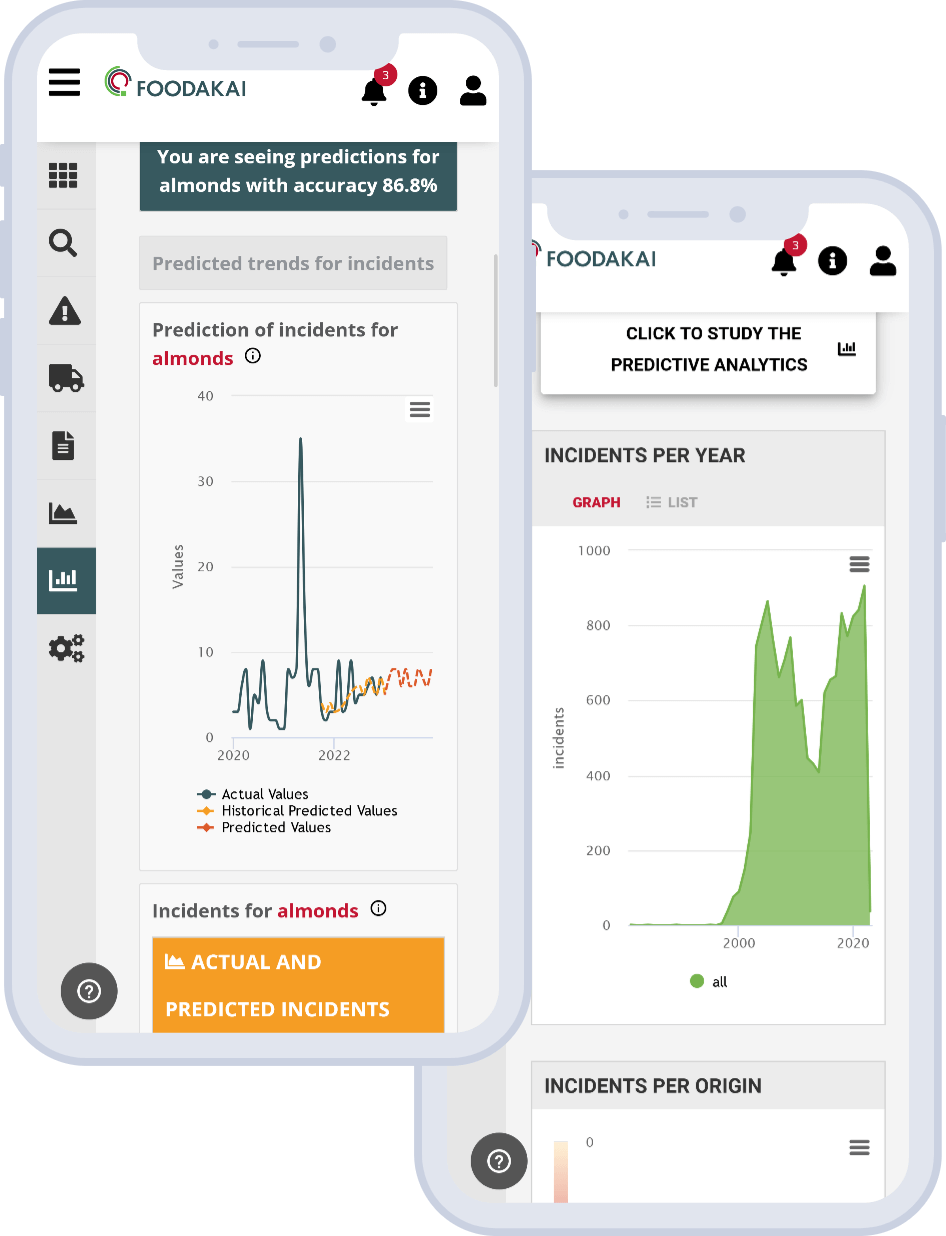

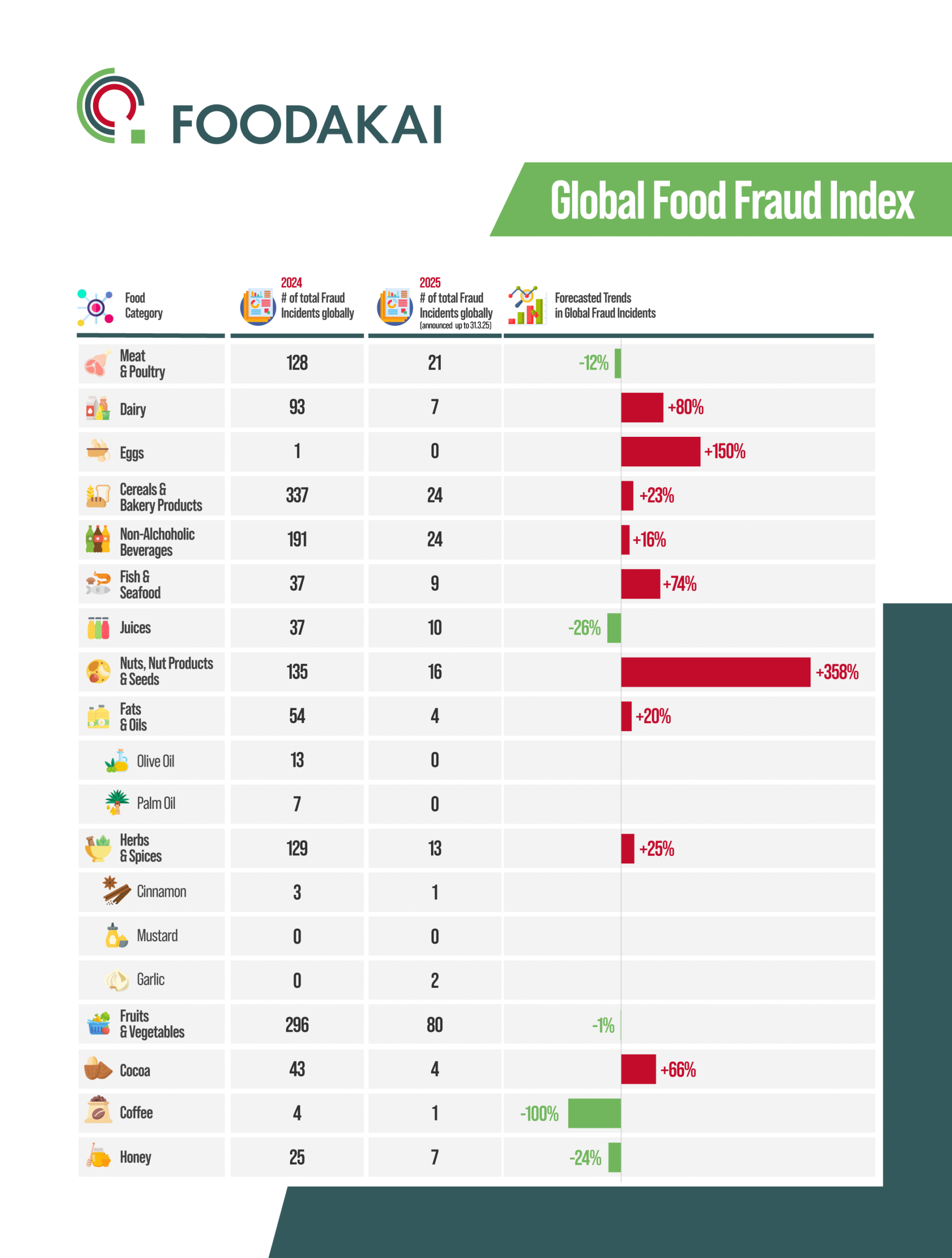

Key risk categories show early-year volatility as total fraud activity begins to shift globally. FOODAKAI’s Global Food Fraud Index, tracking incidents of food adulteration and fraud in high-risk commodities worldwide, reveals a complex picture emerging in the first quarter of 2025. While the overall volume of reported fraud incidents has not yet reached the levels seen across all of 2024, early signs point to concentrated surges in several important product categories — with implications for industry vigilance, sourcing strategy, and food integrity programs.

The rise in fraud across nuts, dairy, and cereals is especially important for procurement, quality assurance, and compliance teams. These products often involve long, fragmented supply chains and are vulnerable to economically motivated adulteration, substitution, and labeling fraud.

Chris Elliott, Professor of Food Safety and Founder of the Institute for Global Food Security at Queen's University of Belfast, provides an expert reflection upon the findings, especially in terms of emerging and forecasted fraud trends. He sees value in using this index as a tool to help businesses target their resources to counter the threats:

“It is extremely important for the food industry to identify the commodities most at risk from food fraud globally. FOODAKAI’s Global Food Fraud Index has identified some new threats I was unaware of while others were high on my own radar.”

Key Insights from Q1 2025

The food fraud landscape is shifting — not in overall volume yet, but in where the risks are concentrated. Several categories have emerged as early hot zones, with sharp increases in fraud activity that could signal larger trends ahead:

- Nuts, seeds, and nut-based products are showing an intense spike in fraud activity. This category is expected to remain volatile, as demand, price pressure, and supply chain complexity continue to create ideal conditions for adulteration and mislabeling. Due to their high market value and broad sourcing geography, expect continued fraud risks — particularly around species substitution, origin mislabeling, and contamination with undeclared allergens. Authentication testing and supplier verification are critical.

Prof. Elliot’s reflection: “I fully agree with this assessment: I am deeply concerned about nuts, especially in products that contain powdered forms due to their allergenicity and ease with which they can be mixed in this form. Due to market shortage and price rises of some varieties such as walnuts, almonds and pistachios.”

- Dairy has seen a small number of incidents so far in 2025, but those cases are already triggering concern due to their nature and the risk of escalation. The category is forecasted to experience rising fraud activity over the coming quarter — something food safety teams should be preparing for now. Watch for dilution, counterfeit labeling, and the use of non-declared additives. Small fluctuations in reported incidents can rapidly escalate; this is a category to actively monitor in Q2.

Prof. Elliot’s reflection: “I also agree with dairy as a heightened risk: Reports of ‘fake butter’ in Russia as well as generally higher milk prices so far in 2025 compared with the past few years and all indicators that dairy products should be considered high risks.“

- Cereals and bakery products continue to be targeted for fraudulent activity, with incidents ranging from origin misrepresentation to undeclared ingredients. This category remains on an upward trajectory. Common fraud includes the use of unauthorized additives or mislabeled gluten content. If sourcing from new suppliers or regions, consider additional scrutiny for documentation and ingredient authenticity.

Prof. Elliot’s reflection: “I very much agree with this assessment: Due to climate change there are increasing need for the use of pesticides (some legal and some illegal) to fight disease in crops. When crops are found to be above legal limits (e.g. EU, USA, CODEX) they must be sent to alternative markets which gain less profits. The same situation is true for mycotoxins. For these crops to enter the desired markets there are possibilities of fraud in terms of false laboratory testing documentation.”

- Fish and seafood remains a high-risk category, with incidents continuing to accumulate at a faster pace than in many other sectors. Fraud in this space is often difficult to detect, making prevention and verification strategies essential. Species substitution remains rampant. Engage in DNA testing programs or trusted third-party audits, especially for imports.

Prof. Elliot’s reflection: “Again I find this assessment accurate: I hear industry reports of increased levels of fraud and not only species substitution. In aquaculture, due to increased issues of disease there are indications that some producers are using high levels of antibiotics (mainly illegal types) in their systems . Species such as shrimps and prawns seem to be worst affected.”

- Non-alcoholic beverages are emerging as an unexpected area of concern. This category, which includes flavored drinks, soft drinks, and infused waters, is showing steady fraud activity and is forecasted to increase further. For both juices and non-alcoholic drinks, fraud can take the form of dilution, false labeling (e.g., “natural” claims), or undeclared sweeteners. Marketing and R&D teams should be looped in to ensure label integrity.

Prof. Elliot’s reflection: “I was not aware of any increased concerns in this sector. This is a category I must investigate further.”

- New/Emerging Risks: Keep an eye on garlic, which appeared in fraud reports for the first time this quarter, and any unusual signals in smaller subcategories — they often precede broader issues.

Prof. Elliot’s reflection: “I agree with this assessment: I have picked up a lot of concerns about garlic in terms of its country (region) of production and adulteration with low cost bulking agents.”

At the same time, some categories — including juice products, coffee, honey, and fruit & vegetable items — have shown declining or stable fraud activity so far in 2025. While this offers some reassurance, food companies should treat these trends cautiously, as historical data shows these categories can fluctuate quickly due to seasonal and geopolitical drivers.

Prof. Elliot’s reflection: “I am surprised to see coffee not listed as a commodity on the ‘risk list’. I hear more reports of fraud in this commodity driven by crop failures and soaring prices. Counterfeiting of major brands has also come to my attention.”

Ultimately, the food industry should continue shifting from reactive to predictive risk management — using early indicators like those in the Global Food Fraud Index to anticipate vulnerabilities and act before issues escalate.

About the Index

The FOODAKAI Global Food Fraud Index is a quarterly snapshot of food fraud and adulteration trends globally. Based on official data from national and international food safety authorities, the index helps manufacturers, regulators, and supply chain stakeholders anticipate emerging risks and benchmark recall activity over time.

📬 Sign up for free alerts of globally reported food safety and fraud incidents here.

Acknowledgement of Horizon EFRA project (Extreme Food Analytics): This Food Risk Report was prepared under the EFRA project, as a Sectoral Data Report.

EFRA is a project that has received funding from the European Union’s Horizon Europe Research and Innovation Programme under Grant Agreement No 101093026

Project website: https://efraproject.eu