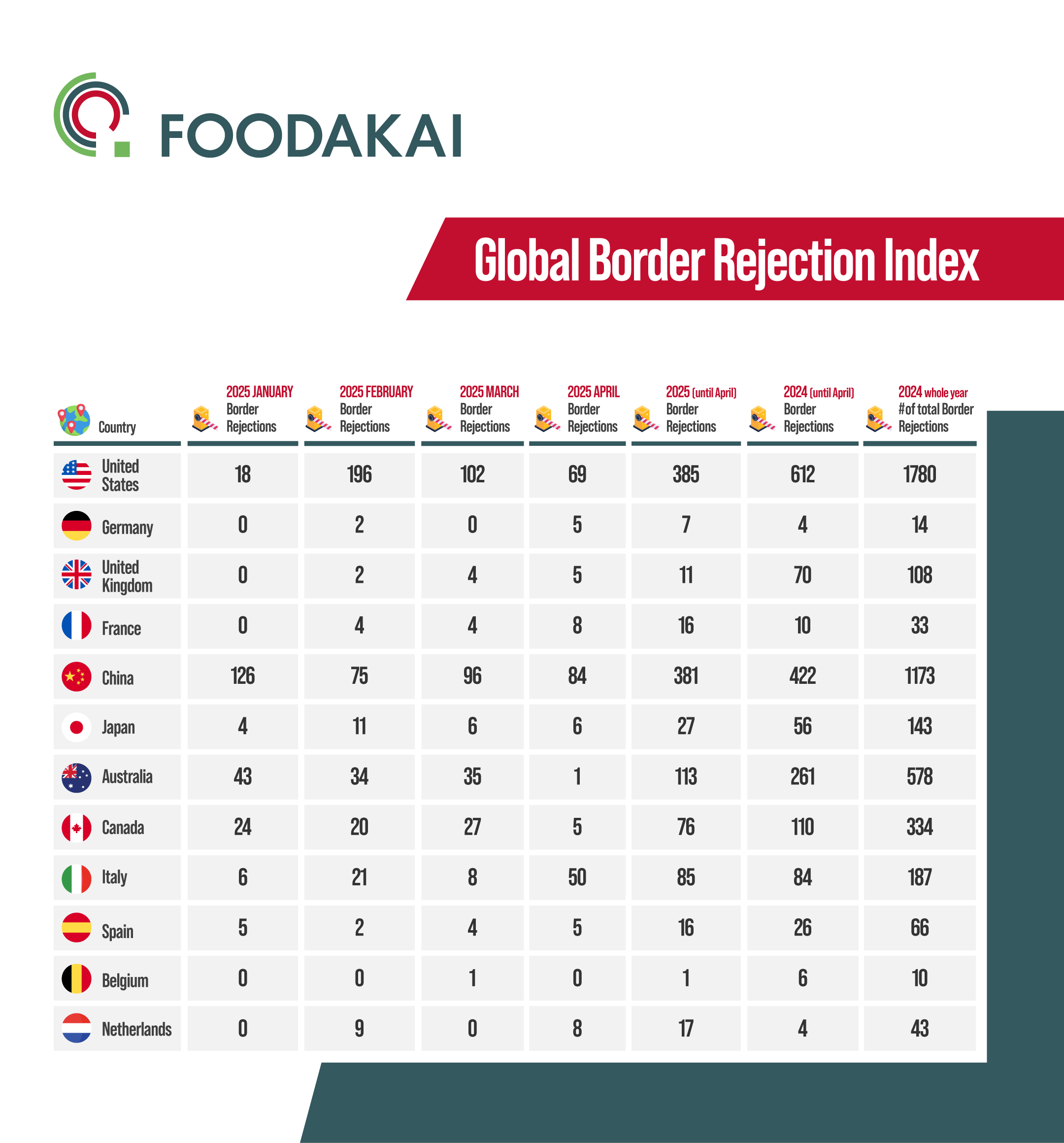

Food Imports Under Scrutiny: Latest FOODAKAI Index Reveals U.S. and China Top Global Border Rejections

Agroknow has released the latest edition of FOODAKAI’s Global Border Rejections Index, offering critical insights into food safety and compliance across leading food-importing countries. From January to April 2025, the United States and China emerged as the most active markets in rejecting food shipments, each recording over 380 border rejections.

Key Insights from 2025 so far

The data reveals not just where rejections happen—but also when sudden spikes occur. Staying informed about these trends can help exporters adjust risk assessments and plan audits accordingly.

The U.S. saw a total of 385 food import rejections—while this shows a decrease compared to the 612 cases recorded during the same period in 2024, it still positions the U.S. as a dominant force in food safety enforcement. China, with 381 rejections, is nearly on par, maintaining a stable level versus last year’s 422 cases.

Italy reported a steep rise in April with 50 rejections, pushing its total for the first four months of 2025 to 85—indicating a potential shift in regulatory vigilance. Meanwhile, Australia (113) and Canada (76) also remain high on the list, though Australia has experienced a significant drop from 261 in the same period last year.

On the other hand, several European nations recorded consistently low rejection numbers. Germany had only 7 rejections so far this year, Belgium just 1, and France 16—reinforcing their status as low-risk exporters. The United Kingdom saw a dramatic improvement, with only 11 rejections compared to 70 in the same period last year.

The index underscores the importance of staying proactive in managing regulatory compliance risks. To help food industry professionals stay ahead, FOODAKAI is offering free alerts on globally reported food safety incidents.

About the Index

The FOODAKAI Global Borer Rejection Index is a monthly and quarterly snapshot of global food safety risks related to border rejections. Based on official data from national and international food safety authorities, the index enables manufacturers, regulators, and supply chain stakeholders to monitor patterns of food fraud, contamination, and non-compliance — helping them anticipate emerging risks and benchmark rejection activity across markets.

![]()

Acknowledgement of Horizon STELAR project (Spatio-TEmporal Linked data tools for the AgRi-food data space): This Border Rejection Index Report was prepared under the STELAR project. STELAR is a project that has received funding from the European Union’s Horizon Europe Innovation Programme under Grant Agreement No 101070122

Project website: https://stelar-project.eu/